The State of Neobanking: Alarming Trends and Exciting Developments to Watch in 2020 and Beyond

If traditional banks aren’t paying attention to so-called ‘challenger-banks’ thinking that the current system is future-proof enough to withstand a few more decades of brazen disregard for the public good and common sense, they’d better think again.

Will Seemingly Immovable Objects Crumble Before Unstoppable Forces?

It seems to me that quite a few institutional banks insist on continuing to play the same rather predatory role in their customers’ lives instead of adjusting their operating models to better serve the public’s constantly shifting needs and expectations, but let’s not get too negative from the get-go. Of course, not all big banks are asleep at the wheel. There are plenty of examples of forward-thinking in both commercial and investment banking and, astonishingly, in many cases, they come from the organisations that have given us the 2008 crisis. Goldman Sachs, for instance, since the launch of its high-tech digital banking platform Marcus, has built a $60 billion consumer business in the US and UK. JP Morgan Chase has done well for itself having partnered with Roostify to provide digital mortgage services and making a deal with online lender OnDeck to service the SME’s quick loan needs. The Commercial International Bank (CIB) of Egypt is picking up slack by providing its customers with up to date payment and money transfer solutions embracing mobile P2P schemes without the need to open an account.

It’s quite apparent that some of the whales are swimming in what they perceive as the right direction. Government regulators are becoming much more agile in licensing challenger banks. Lately, the usually extra rigid Monetary Authority of Singapore (MAS), is keen on granting digital banking licenses to third-party companies. Malaysia, a close second in issuing digital banking licenses in the region, is expected to grant permissions to operate to some of the local giants – Grab, Razer, AirAsia, Axiata and CIMB.

Indeed, one would have to be blind, deaf and dumb not to take the direction that mobile-driven adoption of low-cost tech-intensive neobanking is taking. The Bank of Thailand (another highly conservative institution) has announced a bid to delve deeper into digital and possibly grant some digital banking licenses. Bank of Israel (a supposed innovation capital of the world) is surprisingly late at the party announcing the licensing of the first new Israeli bank in forty years and the beginning of digital-heavy operations in mid-2021.

And, if there’s a banker left in the world who is still not convinced that a light footprint of mobile consumer banking is the way of the future, they can always look at the country where people aren’t so eager to schlepp to a branch in 45°C heat. I’m talking about Qatar with its highest in the world rate of digital consumer adoption, more than 100% smartphone penetration (not sure how that works) and over 99% internet penetration.

So why isn’t everybody doing it? The reason why all banks aren’t frantically dropping their antiquated ways in favour of cheap, efficient, universally accessible and versatile neobanking could be existential. Consider that about 30% of American and European households aren’t making enough to bother with money management (and I’m not even touching the rest of the globe). Those stats are well known to financial institutions and some of them assume that the risk and expense connected with a radical change of a business model is not justified in the world ravaged by hopeless poverty. Instead, bankers prefer getting on a debt gravy train, which has served them very well in the past, and continues to deliver mind-boggling dividends in the sector.

The remedy here is both simple and impossibly complex. It seems to me that the urgency to create, introduce and implement a new universal economic model beneficial for consumers, businesses, and governments alike is here. Rethinking predatory capitalism will go a long way in creating the money supply sufficient for new earning, investing and banking habits – and that’s when it begins to make sense for a low-income consumer to download a mobile money managing app.

Is More Always Better?

However we feel about it, what we see is banking transforming dramatically making brand new instruments available to depositors and investors, going digital for safer and faster value transfers and more efficient asset management. Full or partial automation is being introduced on all levels of operations for more accurate data analysis, reliable audits, and optimised fee structuring. The enhanced customer experience, wider adoption of blockchain-based digital assets, new investment/value-storage practices and significant cost reduction are the themes of the day.

It seems like almost every day some snazzy money-managing app pops up on a fintech press radar, and then the next thing we know gobs of money are being poured into it by the folks with the rare and enviable skill to turn millions into billions.

The latest adventure in the unending ‘raise or die’ saga is the German ‘direct bank’ N26 that just a few months back ecstatically announced the additional $300m boost from its backers bringing its valuation up to a majestic $2.7bn, but N26 – the now largest fintech start-up in Europe – is entering a very crowded sector.

Remember Monzo with its £2bn valuation? How about Revolut who raised $500 million in equity plus an additional $1 billion convertible loan from JP Morgan bocoming the largest ever private capital raise for a fintech enterprise on record? Starling Bank has done very well for itself, raising a total of £263 million to date. Atom can hardly be considered a ‘challenger bank’ any more with the valuation of over half a billion sterling. The same goes for Tandem. And that’s not mentioning the host of smaller digital banks competing eagerly for particular segments within the industry, be it foreign-currency transfers or electronic payments.

It’s clear that the space is not only overcrowded and grossly overinvested, with this much VC money sloshing around in it it’s headed for a disaster. The industry needs to cool down, focusing more on the needs of private citizens, local communities, small businesses, and, I can’t stress this enough, cryptocurrency enthusiasts. In other words, if film reference is appropriate here, let’s recall Jerry Maguire’s “less money” soliloquy – too much cash in a company account does not necessarily translate into a recipe for individual freedom, clear conscience, and business success.

Today, on the one hand, we have a finance industry certainly ripe for disruption and open for innovation from virtually all corners of the fintech spectrum. On the other hand, GAFA (Google, Amazon, Facebook, Apple) is getting ready to gobble up the entire neobanking sector. From the looks of it, it may be a good time to think about delivering a real sense of community into banking. Whether it means going back to basics or packaging new functions and services in a way that all – rich, poor, old, young, tech-savvy and computer illiterate – would finally enjoy their banking experience remains to be seen, but there are some credible attempts at breathing new air into the space.

Will Sleeker Apps and Better UX/UI Help?

The question ‘Why do I go to the bank’ doesn’t need answering, but why go to a specific bank? How to choose the right bank? Which criteria do I use to decide on who is going to service my banking needs? Now, those are the questions neobankers are rightfully concerned with, and for some reason many traditional bankers aren’t.

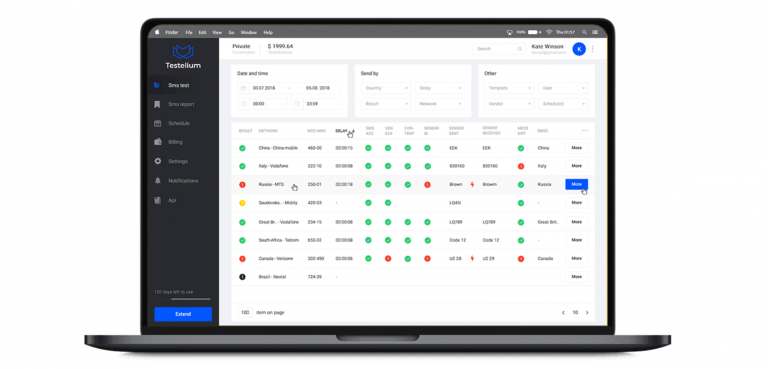

For neobankers the conversation begins and stops with the value they intend to provide. Particularly, the value of saving time (the sign-up process is fast and easy), the convenience of mobile use (app-based banking, instant notifications, on-screen reports), the accessibility of the mobile interface (the quality of mobile UI is often the difference between a successful project and a flop), the perks (payment cards with online transaction capabilities, bonuses, accrued benefits, exclusive member programs, ATM withdrawals in multiple currencies including cryptocurrencies).

Will DLT Make Banking and Investing a Breeze?

On Jan 28, 2020, Citibank and Goldman Sachs used the network built by the blockchain technology provider Axoni and conducted an equity swap. Sounds trivial, but know this: a synchronised real-time transaction of this sort between two banks with their own data sets, books, and digital protocols is a huge deal. It took Axoni years to set it up, bringing in 15 participants on both the buy, and sell side. What is remarkable about this particular trade is that it’s wholly underlined by the DLT, which finally makes the natural hurdles in the equity trading space – expensive data breaks and general protocol incompatibility – a thing of the past.

The proliferation of distributed ledgers is the most important trend in digital banking because DLT, essentially, redefines data handling, and modern banking is nothing but distributing data via the right channels. Who deposited when, where, and what, which currency was used, how do exchange rates stack up when I use USD in France or Bitcoin in Singapore? Those and many more questions are answered by the use of the blockchain-based banking platforms.

Another useful aspect of blockchain-based banking is emerging opportunities in creating passive income. Today the numbers aren’t that formidable but in the future look for digital banking platforms/apps enabling you to set aside a small portion of commissions you earn during your daily operations and invest those on your behalf. Smart automation is the key here; regulated investment/banking platforms attract customers with ease of operation and availability of multiple investment projects for any pocket with everything laid out for their clients in perfect clarity from the get-go. Something to think about, given that gig economy is growing: a 2018 report by the Foundation for European Progressive Studies states that over 35% of the then-current EU workforce was making its nuts working gigs. In 2020, that number is expected to go up to 43%. This is an unprecedented opportunity for a bank, be it a traditional establishment or an online boutique solution, that can provide a toolbox to comprehensively manage their financial health in the tumultuous waters of the gig economy.

Tighten Up Here, a Little Padding there

Money is getting cheap these days. The reason being is the topic for another article, but what’s curious is the fact that the emergence of neobanks coincided with the massive spell of cutting interest rates. The most intuitive tech entrepreneurs seized the moment, got licensed by central banks of the EU countries or made deals with existing banks to piggyback off their licenses and started a revolution big banks were certain would never happen. Indeed, who would have thought that by lowering costs, eliminating fees, providing higher savings account rates, and offering cool new services a bank can get ahead?!

Well, neobankers thought that and figured out the way to provide a major point of difference from big banks. Unlike those, whose services extend merely to contracting deposits (‘printing money’) and storing your cash for you, challengers present their customers with an enviable array of possibilities that improve on virtually every aspect of modern money management.

You sign up using a highly refined mobile interface – easy. You receive a contactless payment card that transacts via the company server, which means that you get everything done faster, more precisely, with options to block/unblock services within the app, turn on/off things like cross-border payments, online operations, and others.

Mark-up fees on operations with various currencies – gone (although, depending on the bank, that feature could be limited to a certain extent).

Is It All About the Business Model?

The bottom line is unless banks continue to rely on a seemingly inexhaustible but outright evil model of charging over 30% interest on credit cards and foreclosing on defaults the next day the grace period is up, to stay in the running in the third decade of the 21st century they’ll have to thoroughly rethink their business model and approach to innovation. Neobanks make money by charging a microscopic transaction fee, packaging premium products into their service contracts, providing great options in foreign exchange, cheap and accessible consumer credit, and premium SaaS at prices per month comparable to that of a latte at Starbucks. Revolut, for one of many examples, is known for its €7.99 per month service with higher limits and the executive-level insurance benefits. And, as if that’s not enough to woo even the most demanding customer, they give you options to operate with crypto and (my personal favourite) disposable virtual cards. In the words of one of the few upcoming challengers worth paying attention to, Smartee, “can your bank do it?”